2022 Q2 Newsletter

Hello all,

For this newsletter, we wanted to focus on providing some perspective on the current market conditions. We understand the concerns individuals have. Periods such as these are challenging to watch, however, they are temporary.

Webinar - Market Outlook

We will be hosting a webinar on markets, Monday June 27th at 4:00 PM PST. Please click the button below to register.

Markets

Markets this year have been volatile. As you have likely heard us say, we were expecting a pullback after the strong returns in 2021. What we were not expecting was the level of inflationary growth and the geopolitical war in Eastern Europe, all occurring within a short 6-month period. Below are a few of the global events tangled together that have created a challenging investment environment:

China’s Zero COVID policy causing disruptions to the supply of goods

Companies are understaffed and have been increasing wages to attract people

Energy prices had been high even before the war in Ukraine

The sanctions on Russia and the war have removed major sources of wheat and fertilizers

Rising interest rates are causing some large investors to indiscriminately sell all their investments, in effect throwing the baby out with the bath water.

Our investment process on the other hand doesn’t waiver. We continue to have an objective view on your portfolios and try to balance not making knee jerk reactions with taking advantage of opportunities to manage risk. Below is an example of some of the metrics we look for when selecting our companies to invest in. Without reading the name of the company below, we have highlighted some of the annual financial numbers they produce, dating back to 2007.

* numbers in the millions (000,000.00)

Not all years saw an increase in sales, net income, or their share price. But over 16 years of market volatility, an investor would have been well rewarded.

News outlets tend to focus on the changes we are going through and the disruptions all around us. We deliberately included the period of the Great Recession (2007-2009), which saw large swings in the market. This company’s worst performing period during the Great Recession was down about 50%.

This year it is off 29% from its peak in December. However well-run companies will continue to execute their strategy and grow overtime. The chart below is the stock price of this same company from 2007 to today. The company has had periods of pullbacks throughout the 16-year period, but the long-term trend is up and to the right!

The company: Microsoft

However, you could do the same analysis of many well-run companies within your investments.

In the meantime, the media will continue to sell fear to catch your attention.

Part of the problem, is we have lived through the last two years where we could not:

Go out

See friends and family

Travel

Just when we start to see an end to restrictions and the possible return to normal, inflation starts to peak, central banks raise interest rates and war has been thrust upon Ukraine. All of us feel we have had it – and rightfully so! This market downturn is emotionally harder to deal with than the period of 2008 and 2009.

Our expectation is markets will look for inflationary growth to cooldown and supply chain issues to show signs of repair before confidence is restored. We don’t know when this will happen however would like to highlight the importance of being patient over the next couple of months. Given markets are much closer to the bottom today than in January 2022, we see many of the companies currently owned in your portfolio as being on sale (food for thought!).

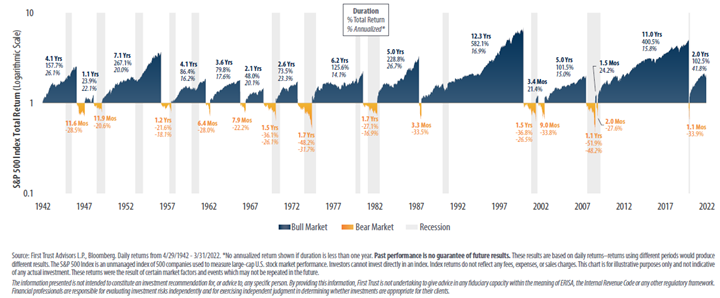

We wanted to leave you with the chart below. This represents the top 500 companies in the US (S&P500 index) over the last 80 years. Blue represents times when markets are going up (bull market) and orange represents times when markets are going down (bear markets). Typically, we see prolonged periods of bull markets followed by relatively short (temporary) periods of bear markets. Every time these occur, it’s easy to think this can last forever – however we always have found a way through.

The chart above shows that approximately 70% of the time markets move up. If you were to go to a Vegas slot machine, knowing that every time you pulled the lever your odds of winning were 70%, you would never stop.

If you have questions, please don’t hesitate to contact us.

Travis Kidson, B.Sc, CFP®, CIM®

Portfolio Manager | iA Private Wealth

Insurance Advisor | iA Private Wealth Insurance Agency

700-609 Granville St. Vancouver, BC

p: 604 895 3486

travis@beaconwealthpartners.ca

Jack Fournier B.Sc, FMA, CIM®

Portfolio Manager | iA Private Wealth

Insurance Advisor | iA Private Wealth Insurance Agency

700-609 Granville St. Vancouver, BC

p: 604 895 3348

jack@beaconwealthpartners.ca

This information has been prepared by Travis Kidson and Jack Fournier who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Managers can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

Insurance products are provided through iA Private Wealth Insurance Agency which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investors Protection Fund.

Beacon Wealth Partners is a personal trade name of Jack Fournier and Travis Kidson.