2023 Q2 Newsletter

2023 Q2 Newsletter

It has been a busy second quarter of the year.

US legislators came to a last-minute agreement on their budget and debt levels - AGAIN. Former President Trump was arraigned in court - AGAIN.

Artificial intelligence dominates news headlines. Still! (See our last newsletter - Click Here)

Nick Taylor, a Canadian PGA golfer, hit a 72 foot putt in the playoffs to win the Canadian Open!

Our newsletter will focus on the following topics:

Our Next Webinar: Understanding your Investment Statements

Inflation, Interest Rates and S&P 500 Sectors

Planning Process

Mackenzie Information Hack

Wildfires

Website Updates

Our Next Webinar: Understanding your Investment Statements

Often, we get questions from clients about their statements. We think it would be helpful for individuals that want more information on how to read it, to join us in our next webinar. For those that cannot make it, we will record it and post on our website.

To sign up please click here: Register

Inflation, Interest Rates and S&P 500 Sectors

As we mentioned in our previous newsletter, inflation has continued to trend down in the last 3 months. There are still big questions, such as how long will it take for inflation to get back to where it is more comfortable, will employment levels stay strong and how will the economy react?

Central banks follow the Goldilocks approach to inflation, a little bit is fine, but the extremes are not good. Consumers, businesses, and investors all like consistency – so they know what to expect in the future. The Bank of Canada wants inflation to remain between 1% and 3%.

Central banks have two methods of achieving this goal: changing interest rates and controlling the amount of money in the economy. Changes in either take time to effect changes in the economy, which explains why they have begun to pause increases in interest rates. We wouldn’t be surprised if one or two small hikes occur in the future, but the bulk of the hikes have already occurred.

Part of their dilemma is that some of the forces affecting inflation, such as housing starts and wages are beyond their control. Wages are rising partly because companies are struggling to find workers as baby boomers retire.

This year we have seen optimism come back in the markets and investments have rallied. In June we saw the PPI report (Producer Price Index) be negative, at -0.3%. This is relevant as it means the price companies are paying for their goods and services are starting to fall. Overtime as companies try to increase market share of their product or service, the most attractive option for a consumer is a reduced price.

For those clients that have been with us over the years, you have heard us talk (continuously) about technology. We tend to use the famous quote from Wayne Gretzky “skate to where the puck is going, not to where is it”. We still see technology as one of the leading sectors over the next decade as it will continue to help drive innovation and make our lives better.

We have included the above S&P500 chart (top 500 US companies) detailing the performance of the 11 sectors within the index each year. Since 2017, technology has been the leading performing sector within the index 4 of the last 7 years.

Planning Process

There is a lot of noise created by all these sorts of events, and it can cause people to react in ways that is not in their long-term financial interests.

There is always something going on and most of it is good. If we look back to the start of the 20th century, we can see that the poverty rate has fallen dramatically, medical advances allow us to lead healthier and longer lives. At our fingertips, we have access to information and culture from literature and music to movies and clips of people’s lives.

We have a process that helps people take simple steps to achieve their goals.

We combine all their inputs such as pensions, CPP, and savings rate with inflation and market behaviour to provide guideposts so they can be confident of their future.

Mackenzie Information Hack

Over the last couple of weeks, clients who held investments with Mackenzie were unfortunately subject to an information hack. We wanted to let all our clients know that we do not own any Mackenzie investments. If you have investment accounts at other firms, it may be worth checking to see if you were exposed. Mackenzie is offering coverage to those affected.

Often at times these can occur if individuals at a company inadvertently clicking on spam emails – also known as phishing. Our firm continues to try and improve security and provides us with resources, tools and malware to help prevent these issues.

Wildfires

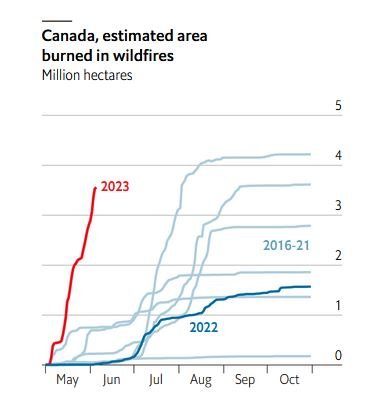

Tragically, we are seeing the worst start to the year with forest fires in Canada. The outskirts of Halifax were devastated and cities throughout the eastern continent have experienced apocalyptic skies from smoke drifting long distances.

Website Updates on Videos

We have added some content to our website. Over the last few months, we have been working on an educational Spotlight Series. The animated videos will help teach fundamental investment knowledge, such as the importance of financial planning and investing money. Our hope was this can be viewed by your children or individuals that want a basic overview on finances. Below are links to our videos, part 3 is coming out shortly.

Fundamental Investment Knowledge: Part 1

Fundamental Investment Knowledge: Part 2

As always, if you have any questions, please feel free to contact us. Enjoy your summer!

Jack Fournier B.Sc, FMA, CIM®

Portfolio Manager | iA Private Wealth

Insurance Advisor | iA Private Wealth Insurance Agency

700-609 Granville St. Vancouver, BC

p: 604 895 3348

jack@beaconwealthpartners.ca

Travis Kidson, B.Sc, CFP®, CIM®

Portfolio Manager | iA Private Wealth

Insurance Advisor | iA Private Wealth Insurance Agency

700-609 Granville St. Vancouver, BC

p: 604 895 3486

travis@beaconwealthpartners.ca

This information has been prepared by Travis Kidson and Jack Fournier who are Portfolio Managers for iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The Portfolio Managers can open accounts only in the provinces in which they are registered.

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

Insurance products are provided through iA Private Wealth Insurance Agency which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investors Protection Fund.

Beacon Wealth Partners is a personal trade name of Jack Fournier and Travis Kidson.